Governance

Governance

Governance

Governance

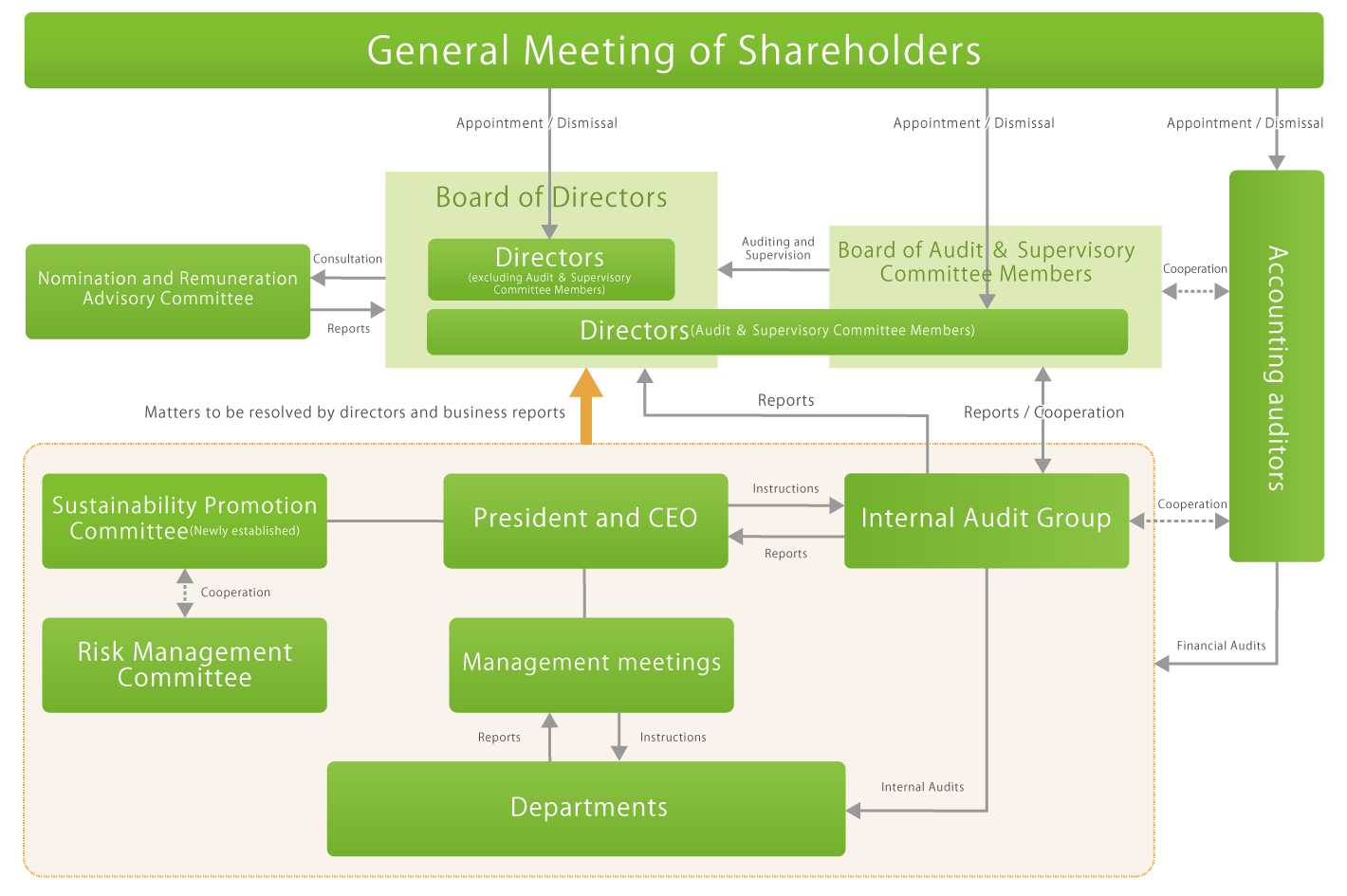

As a publicly traded company, Ceres has established a system to maximize its

corporate value from a long-term perspective as a basic corporate governance goal. It aims to

enhance its management organization in order to improve management efficiency and strengthen

compliance.

Ceres belongs to an internet-related industry where the market landscape is changing

rapidly. We recognize that some of the most important management issues are ensuring the flexibility

of the business, while at the same time increasing our transparency and integrity, and in addition

securing trust from our shareholders, customers, users, employees, and other stakeholders. We will

ensure thorough information management and fulfill our responsibility to stakeholders by disclosing

relevant information without delay. In addition, in order to strengthen compliance, we are

proactively taking measures such as strengthening our internal auditing system as well as improving

leveraged service quality by strict adherence to the rules outlined under the Privacy Mark system.

We will continue to take a sincere approach to improving our internal systems.

Ceres conducts effectiveness assessments of its Board of Directors in accordance with the Corporate Governance Code established by the Tokyo Stock Exchange and discloses summaries of the results in order to enhance the effectiveness of the Board of Directors, build a more comprehensive corporate governance structure, and increase corporate value over the medium to long term.

Ceres established the Nomination and Remuneration Advisory Committee on March 24,

2020, which is composed of a majority of Independent Outside Directors, as an optional advisory body

to the Board of Directors.

The purpose of the Nomination and Remuneration Advisory Committee is

to enhance the corporate governance system by strengthening the independence, objectivity, and

accountability of the Board of Directors' functions regarding the nominations and compensation of

directors, etc. The Committee deliberates on the following items in consultation with the Board of

Directors and reports to the Board of Directors on the contents of such deliberations.

|

Committee Name |

All Committee Members |

Full-time Committee Members |

Inside Directors |

Outside Directors |

External Experts |

Other |

Chairman |

|

|---|---|---|---|---|---|---|---|---|

|

Any committee equivalent to Nomination Committee |

Nomination and Compensation |

3 |

0 |

1 |

2 |

0 |

0 |

Inside Directors |

|

Any committee equivalent to Compensation Committee |

Nomination and Compensation |

3 |

0 |

1 |

2 |

0 |

0 |

Inside Directors |

The expertise and experience of the directors are as follows.

|

Independency |

Corporate Management |

Sales and Marketing |

IT and DX |

Finance and Accounting |

Legal Risk Management |

SDGs and ESG |

|

|---|---|---|---|---|---|---|---|

|

Satoshi Takagi |

● |

● |

● |

● |

● |

||

|

Tetsuya Nozaki |

● |

● |

● |

● |

|||

|

Yasuhiro Kobayashi |

● |

● |

● |

● |

|||

|

Yusuke Shiga |

● |

● |

● |

● |

|||

|

Hitoshi Tada |

● |

● |

● |

● |

● |

● |

|

|

Kana Chitose |

● |

● |

● |

||||

|

Yoshindo Takahashi |

● |

● |

● |

● |

● |

● |

|

|

Masataka Uesugi |

● |

● |

● |

● |

|

Name |

Attributes |

Relationship with Ceres |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

a |

b |

c |

d |

e |

f |

g |

h |

i |

j |

k |

||

|

Hitoshi Tada |

Came from another company |

|||||||||||

|

Yoshindo Takahashi |

Came from another company |

● |

||||||||||

|

Masataka Uesugi |

Lawyer |

|||||||||||

|

Name |

Audit & Supervisory Committee Member |

Independent Director |

Supplemental Explanation of Conforming Items |

Reason for Appointment |

|---|---|---|---|---|

|

Hitoshi Tada |

● |

Mr. Tada has served as a representative and officer mainly at financial institutions. He has abundant experience and insight in corporate management practices. We have elected him as an Outside Director because we believe that he will utilize his qualifications to strengthen Ceres's management supervision abilities. In addition, because he has no special relationship with Ceres and has no conflicts of interest with our management, it has been concluded that he has a high degree of independence and we have designated him as an independent director who is not likely to cause conflicts of interest with general shareholders. |

||

|

Yoshindo Takahashi |

● |

● |

Mr. Takahashi is an advisor at Executive Partners Inc., which provides management consulting services to Ceres. Still, we have determined that there is no problem in designating him as an independent director since he is not the consultant in charge of Ceres, and the transaction amount is insignificant, so he does not fall under the category of our major business partners. |

Mr. Takahashi is appointed as an Outside Director (Audit & Supervisory Committee Member) based on our judgment that he can objectively supervise the relevance of management based on his experience and broad insight, mainly at financial institutions, and utilize his qualifications to strengthen Ceres's auditing abilities. In addition, since he has no conflicts of interest with our Management, it has been judged that he has a high degree of independence and we have designated him as our independent director who is not likely to cause conflicts of interest with general shareholders. |

|

Masataka Uesugi |

● |

● |

Mr. Uesugi is appointed as an Outside Director (Audit & Supervisory Committee Member) based on our judgment that he can objectively supervise the relevance of management based on his experience and broad insight, mainly at financial institutions, and utilize his qualifications to strengthen Ceres's auditing abilities. In addition, he has established a law firm, but it has no special relationship with Ceres and has no conflicts of interest with its management, so it has been judged that he has a high degree of independence and we have designated him as our independent director who is not likely to cause conflicts of interest with general shareholders. |

Executive compensation consists of a basic salary as a fixed kind of remuneration,

restricted stock remuneration (non-monetary remuneration) as a medium- to long-term incentive for

the purpose of continuously improving Ceres’s corporate value and sharing shareholder value, and

bonuses as a short-term incentive.

For Outside Directors, only a basic salary as a form of fixed

remuneration is paid in light of their roles and independence. In addition, at the Board of

Directors meeting held on February 19, 2021, we established the Directors' Remuneration Policy,

which includes a policy for determining the details of compensation, etc. for individual directors

(excluding Directors who are Audit & Supervisory Committee Members). The outline of the policy

is as follows.

From the perspective of maintaining and improving corporate governance and putting basic policies into practice, remuneration for Ceres's Directors (excluding Directors who are Audit & Supervisory Committee Members and Outside Directors) consists of three types: (1) basic salary as fixed remuneration, (2) bonuses as short-term incentive remuneration, and (3) stock remuneration (pre-delivery type restricted stock) as medium- to long-term incentive remuneration. The ratio, etc. shall correspond to the position of the Director. Remuneration for Outside Directors shall be limited to basic salaries, which is a kind of fixed remuneration, in light of their expected roles.

(1) Basic remuneration (Fixed remuneration) Decisions shall be based on comprehensive consideration of the position, full-time or part-time status, career, past salary and remuneration levels, areas of responsibility and duties, and remuneration levels in the same industry, etc.

(2) Bonuses In light of the nature of short-term incentive remuneration and commonality with the interests of shareholders, the amount of basic remuneration for each director shall be determined according to the achievement status of the amount of consolidated net income (meaning net income attributable to shareholders of the parent company as shown in the consolidated statements of income, hereafter referred to as "consolidated net income"), which is resolved by the Board of Directors and announced around February each year as a performance forecast, taking into consideration the position of each director (excluding Directors who are Audit & Supervisory Committee Members and Outside Directors), the amount of basic remuneration for the applicable fiscal year, his/her contribution in the relevant fiscal year, the performance and growth rate of the business division in charge, and other factors.

(3) Stock remuneration (Pre-delivery type restricted stock)

In addition to providing incentives for the sustainable improvement of Ceres’s corporate value,

monetary claims are paid as remuneration to grant restricted stock for the purpose of further

sharing value with shareholders.

The total amount of such stock remuneration shall be

determined on the assumption that it does not exceed 20,000 shares and 2 million yen per year,

taking into consideration the amount of consolidated net income of the group for the applicable

fiscal year. In addition, the number of stock compensation grants for each individual and the

amount of monetary claims to be paid for such grants shall be determined in consideration of the

basic remuneration amount for eligible Directors (excluding Directors who are Audit &

Supervisory Committee Members and Outside Directors. Hereinafter referred to as "eligible

Directors") for the applicable fiscal year, the contribution of each eligible Director during

the fiscal year, the performance and growth rate of the business department in charge, and

trends in the price of Ceres's common stock.

The amount of basic remuneration and bonuses among the directors' remuneration (excluding Directors who are Audit & Supervisory Committee Members) shall be determined individually by the President and Representative Director, who is delegated by the Board of Directors, after mutual evaluation of individual Directors, deliberation and formulation of draft proposals by the Nomination and Remuneration Advisory Committee, and determination of the total amount of each remuneration at the Board of Directors. With regard to stock remuneration (pre-delivery type restricted stock), the amount and the number of shares to be granted to each individual shall be determined by the Board of Directors after deliberation and formulation of a draft proposal by the Nomination and Remuneration Advisory Committee.

Individual disclosures are not made as there is no director whose total amount of

consolidated remuneration, etc. is more than 100 million yen.

The total amount of remuneration,

etc., by category of directors of the submitting company, the total amount of remuneration, etc., by

type of remuneration, etc., and the number of directors subject to the remuneration are as follows.

|

Total amount of remuneration, etc. |

Total amount by type of remuneration, etc. (Thousand yen) |

Eligible |

||||

|---|---|---|---|---|---|---|

|

Basic Remuneration |

Bonus |

Restricted |

Non-monetary compensation, etc. |

|||

|

Directors |

203,021 |

155,850 |

30,000 |

17,171 |

17,171 |

6 |

|

Directors |

15,330 |

15,330 |

- |

- |

- |

4 |

|

Total (including Outside Directors) |

218,351 |

171,180 |

30,000 |

17,171 |

17,171 |

10 |